How to Use Margin Trading on AscendEX

How to Start Margin Trading on AscendEX【PC】

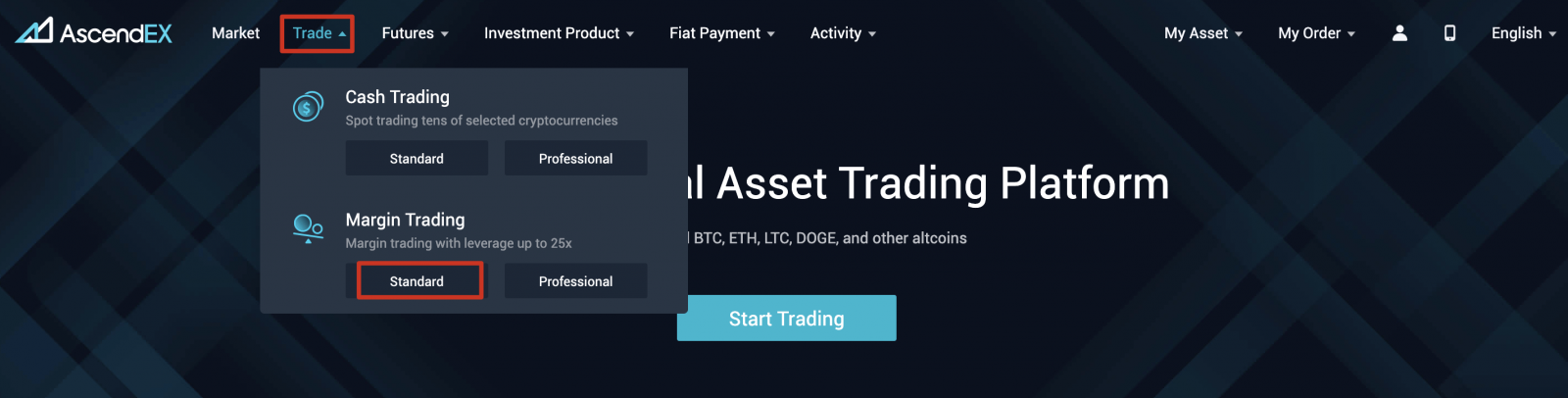

1. Visit AscendEX – [Trading] – [Margin Trading]. There are two views: [Standard] for beginners, [Professional] for pro traders or more experienced users. Take [Standard] as an example.

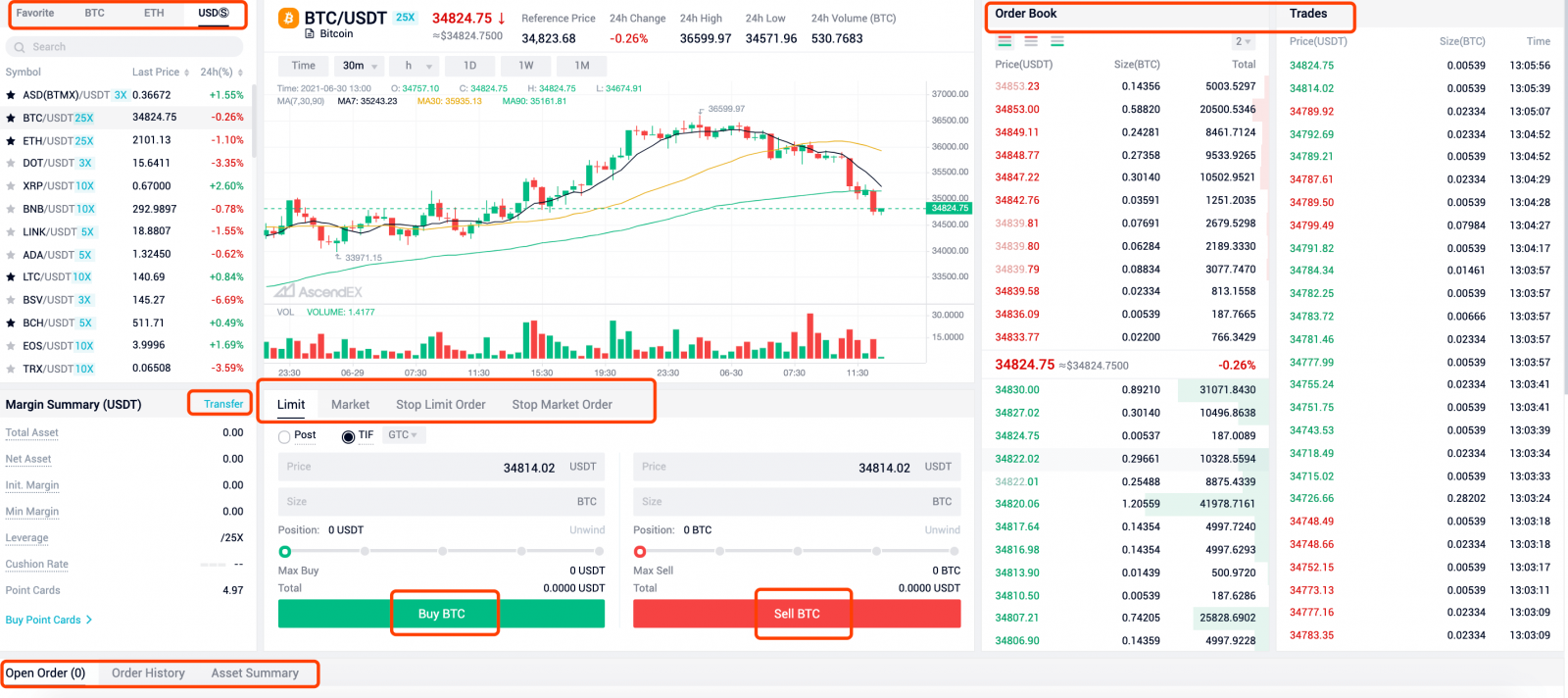

2. Click on [Standard] to enter the trading page. On the page, you can:

- Search and select a trading pair you want to trade on the left side.

- Place buy/sell order and select an order type in the middle section.

- View candlestick chart in the upper middle area; check order book, latest trades on the right side. Open order, order history and asset summary are available at the bottom of the page.

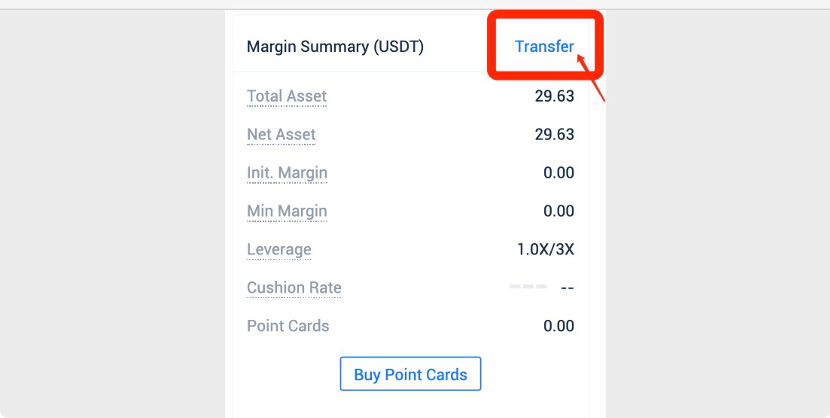

3. Margin information can be viewed on the left middle section. If you currently don’t hold any asset in the Margin Account, click on [Transfer].

4. Note: AscendEX Margin Trading adopts cross-asset margin mode, which means users can transfer any asset to Margin Account as collateral, and borrow multiple types of asset simultaneously against the same collateral.

Under this mode, all assets in your margin account can be used as collateral to mitigate risks of unnecessary liquidation and potential losses.

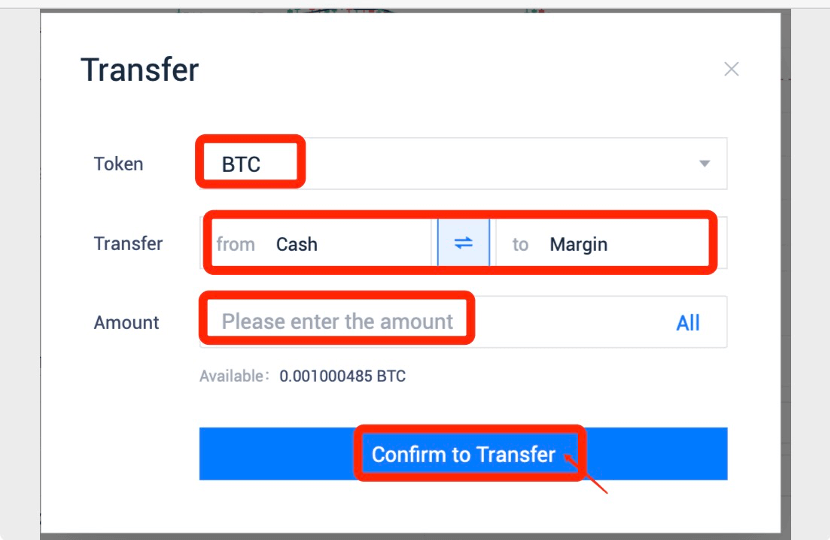

5. You can transfer BTC, ETH or USDT to Margin Account, then all account balance can be used as collateral.

- Select the token you would like to transfer.

- Transfer from [Cash] to [Margin] (users can transfer between Cash/Margin/Futures accounts).

- Enter a transfer amount.

- Click on [Confirm to Transfer].

6. When the transfer is completed, you can start Margin Trading.

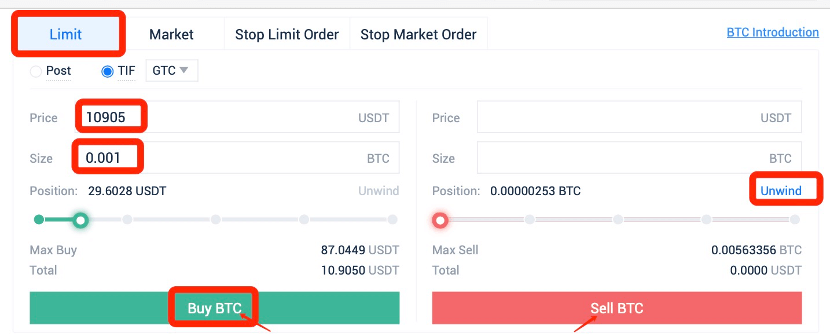

7. Assume you want to place a limit buy order of BTC.

If you expect BTC price to go up, you can borrow USDT from the platform to long/buy BTC.

- Click on [Limit], enter an order price.

- Enter an order size; or you can move the button along the bar below to select a percentage of your max buy as order size. The system will automatically calculate the total trading volume (Total).

- Click on [Buy BTC] to place the order.

- If you want to close out the position, click on [Unwind] and [Sell BTC].

Steps to place a market buy order are pretty similar except that you don’t need to enter an order price, since market orders are filled at the current market price.

8. If you expect BTC price to go down, you can borrow BTC from the platform to short/sell BTC.

- Click on [Limit], enter an order price.

- Enter an order size; or you can move the button along the bar below to select a percentage of your max buy as order size. The system will automatically calculate the total trading volume (Total).

- Click on [Sell BTC] to place the order.

- If you want to close out the position, click on [Unwind] and [Buy BTC].

Steps to place a market sell order are pretty similar except that you don’t need to enter an order price, since market orders are filled at the current market price.

(Open order of margin trading will lead to the increase of Borrowed Asset even before the order execution. However, it will not affect the Net Asset.)

Interests of margin loan are calculated and updated on user’s account page every 8 hours at 0:00 UTC/8:00 UTC/16:00 UTC/24:00 UTC. There’s no margin interest if user borrows funds and repays the loans within the 8-hour settlement cycle.

Interest portion will be repaid prior the principal portion of the loan.

Notes:

When the order is filled and you are worried that the market might move against your trade, you can always set a stop loss order to mitigate the risk of forced liquidation and potential losses. For further details, please refer to How to Stop Loss in Margin Trading.

How to Start Margin Trading on AscendEX 【APP】

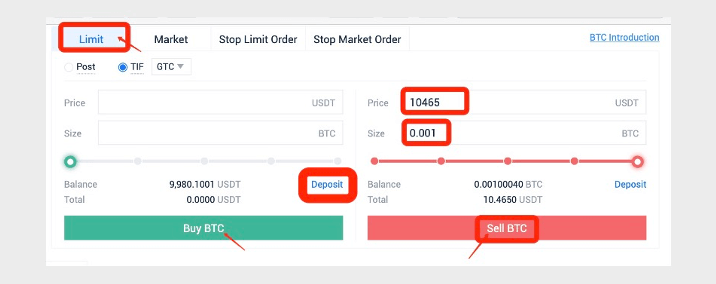

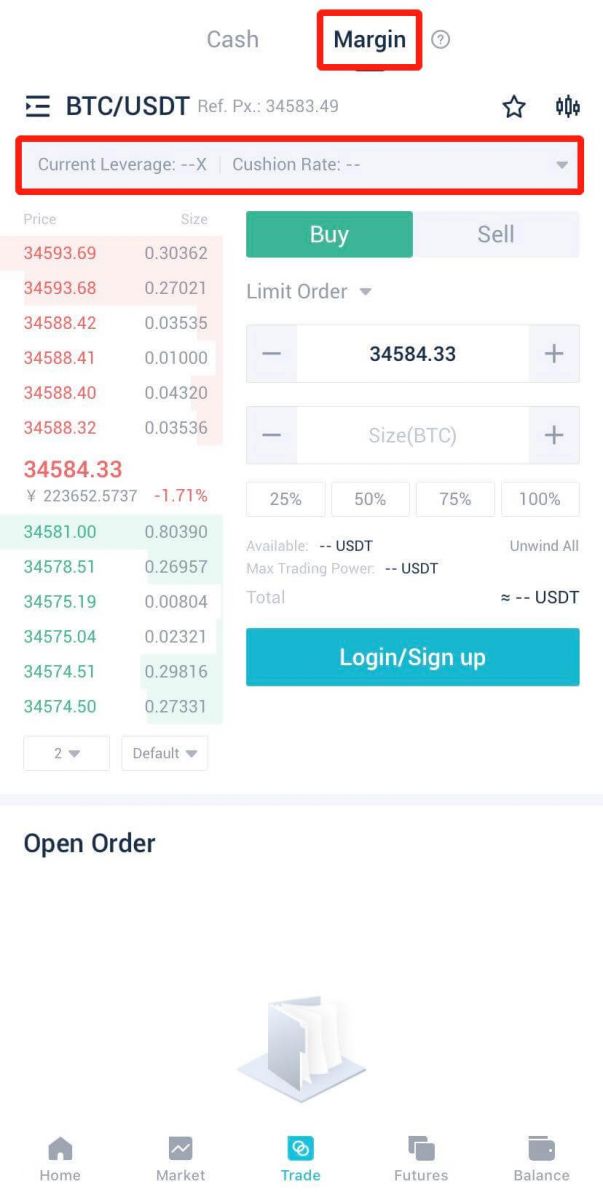

1. Open AscendEX App, visit [Homepage] – [Trade] – [Margin].You need to first transfer assets to Margin Account before trading. Click on the grey area under the trading pair to visit Margin Asset page.

2. Note: AscendEX Margin Trading adopts cross-asset margin mode, which means users can transfer any asset to Margin Account as collateral, and borrow multiple types of asset simultaneously against the same collateral.

Under this mode, all assets in your margin account can be used as collateral to mitigate risk of unnecessary liquidation and potential losses.

3. You can purchase point card or transfer assets on the Margin Asset page. Take asset transfer as an example, click on [Transfer].

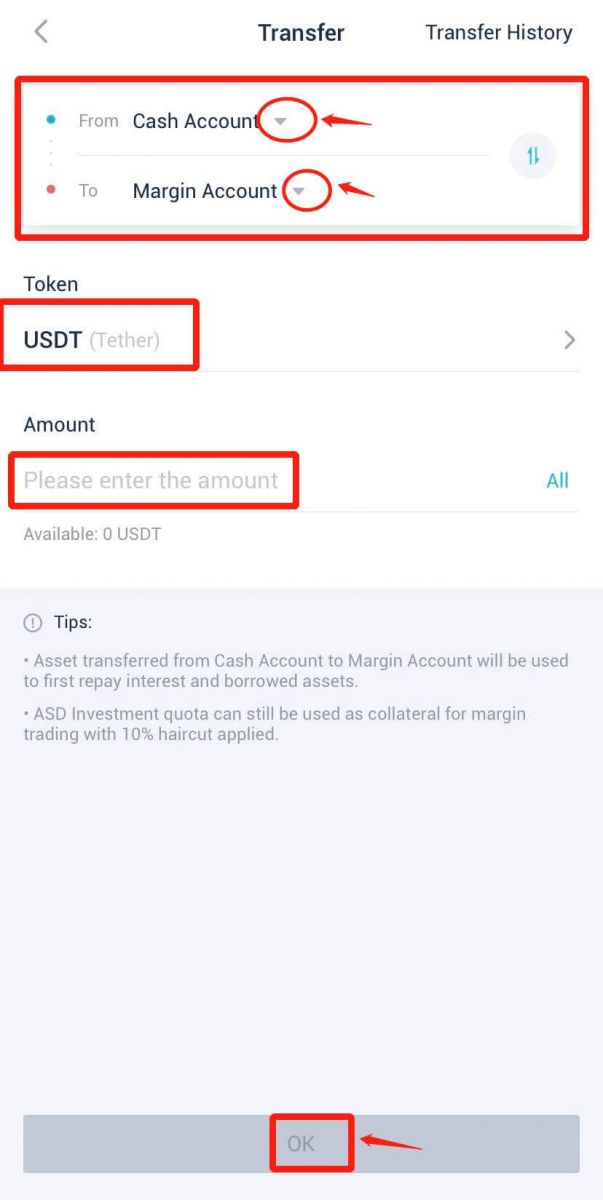

4. You can transfer BTC, ETH, USDT or XRP to Margin Account, then all account balance can be used as collateral.

A. Click on the inverted triangle button to select [Cash Account] and [Margin Account] (users can transfer between Cash/Margin/Futures accounts).

B. Select the token you would like to transfer.

C. Enter a transfer amount.

D. Click on [OK] to complete the transfer.

B. Select the token you would like to transfer.

C. Enter a transfer amount.

D. Click on [OK] to complete the transfer.

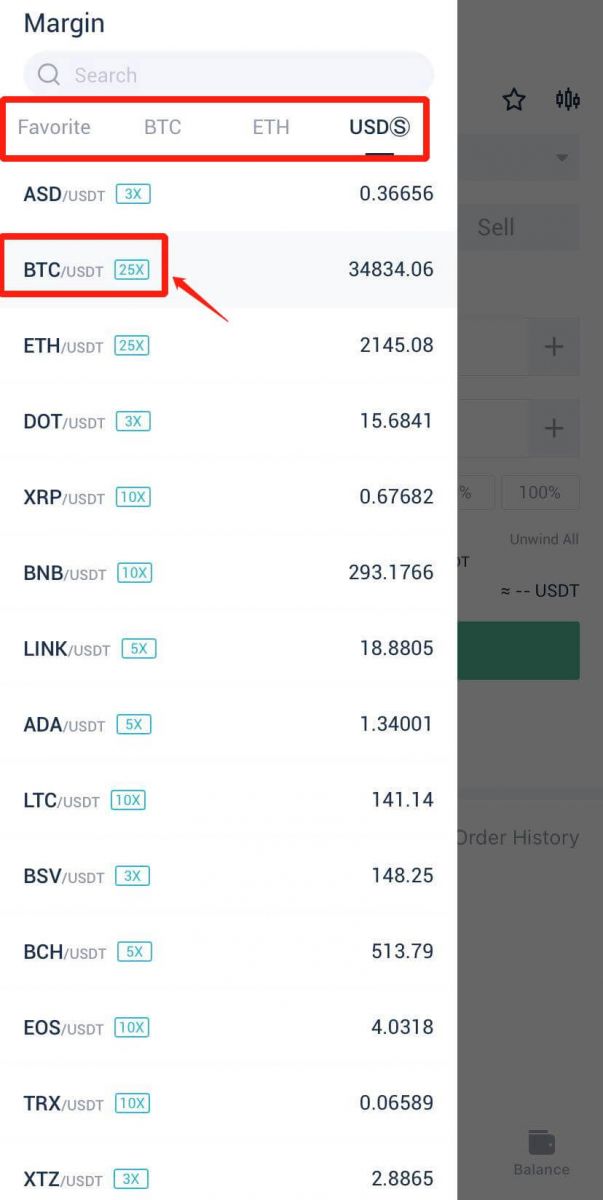

5. When the transfer is completed, you can select a trading pair to start Margin Trading.

6. Click on the symbol to choose from BTC/ETH/USDT trading pairs. Assume you want to place a limit buy order to trade BTC/USDT.

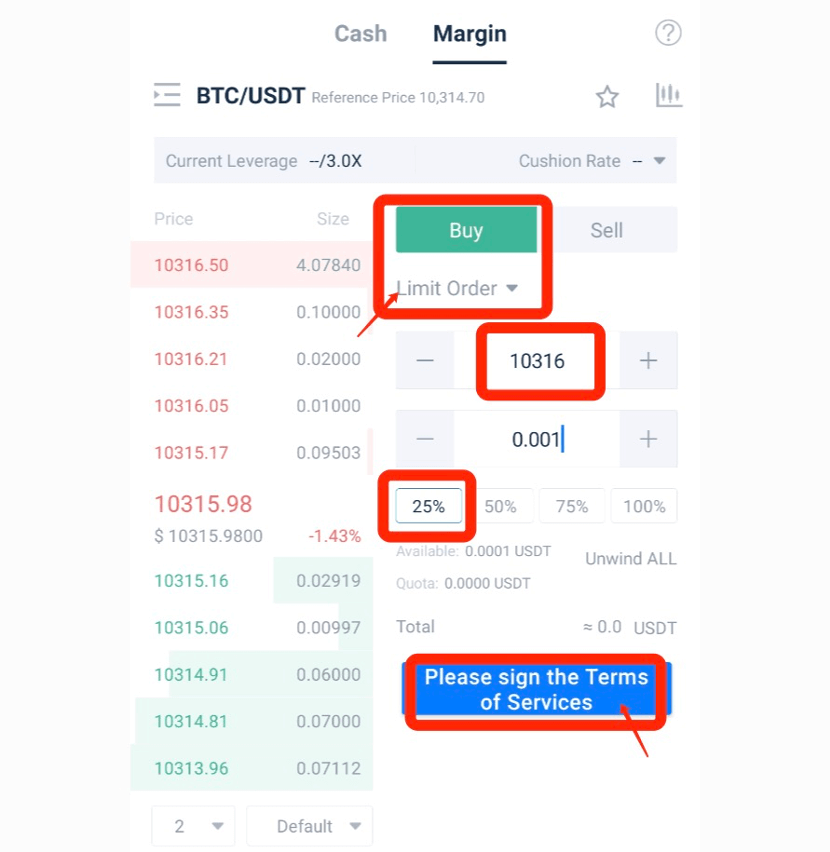

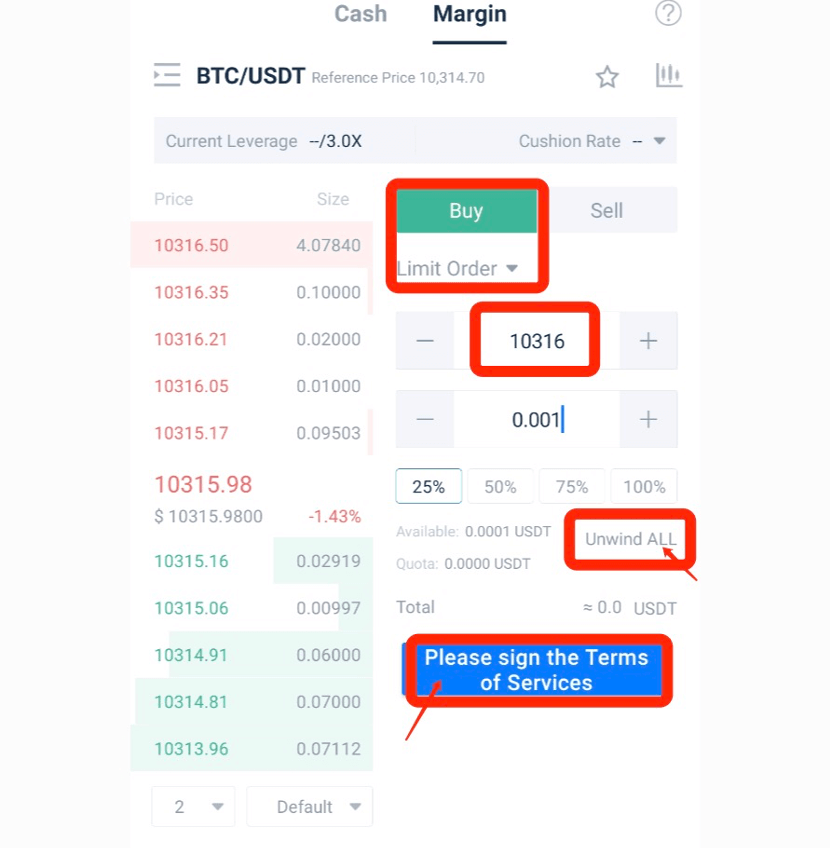

7. If you expect BTC price to go up, you can borrow USDT from the platform to long/buy BTC.

A. Click on [Buy] and [Limit Order], enter an order price.

B. Enter an order size. Or you can select a size by clicking on one of the four options below (25%, 50%, 75% or 100%, representing a percentage of your max buy). The system will automatically calculate the total trading volume (Total).

C. Click on [Buy BTC] to place the order.

B. Enter an order size. Or you can select a size by clicking on one of the four options below (25%, 50%, 75% or 100%, representing a percentage of your max buy). The system will automatically calculate the total trading volume (Total).

C. Click on [Buy BTC] to place the order.

Steps to place a market buy order are pretty similar except that you don’t need to enter an order price, since market orders are filled at the current market price.

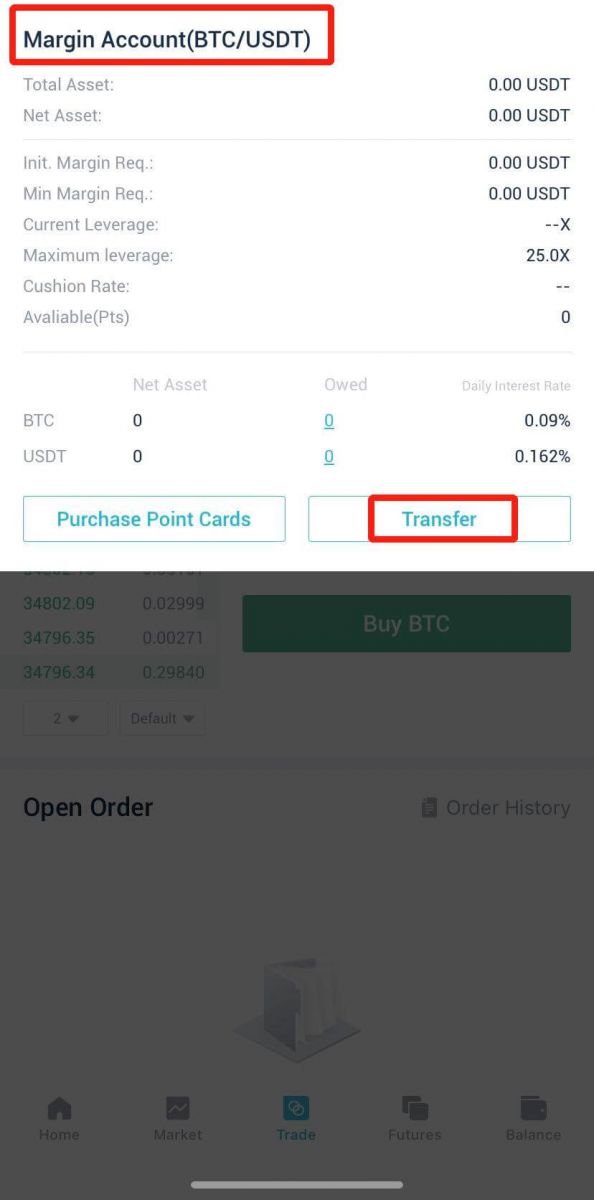

8. To close out the limit/market buy order, you can simply place a limit/market sell order.

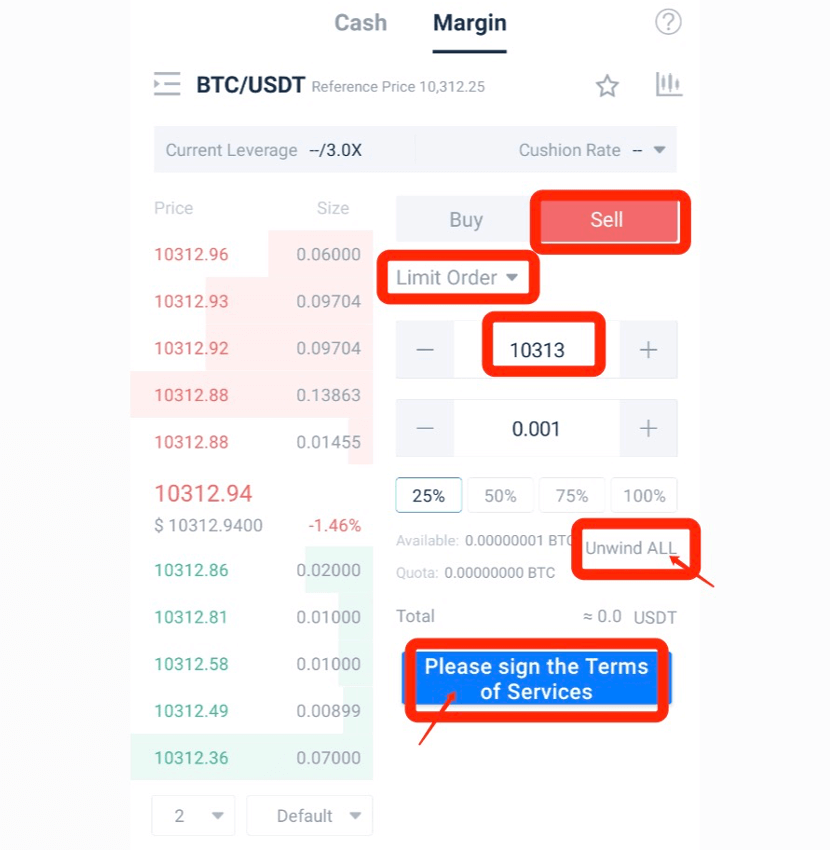

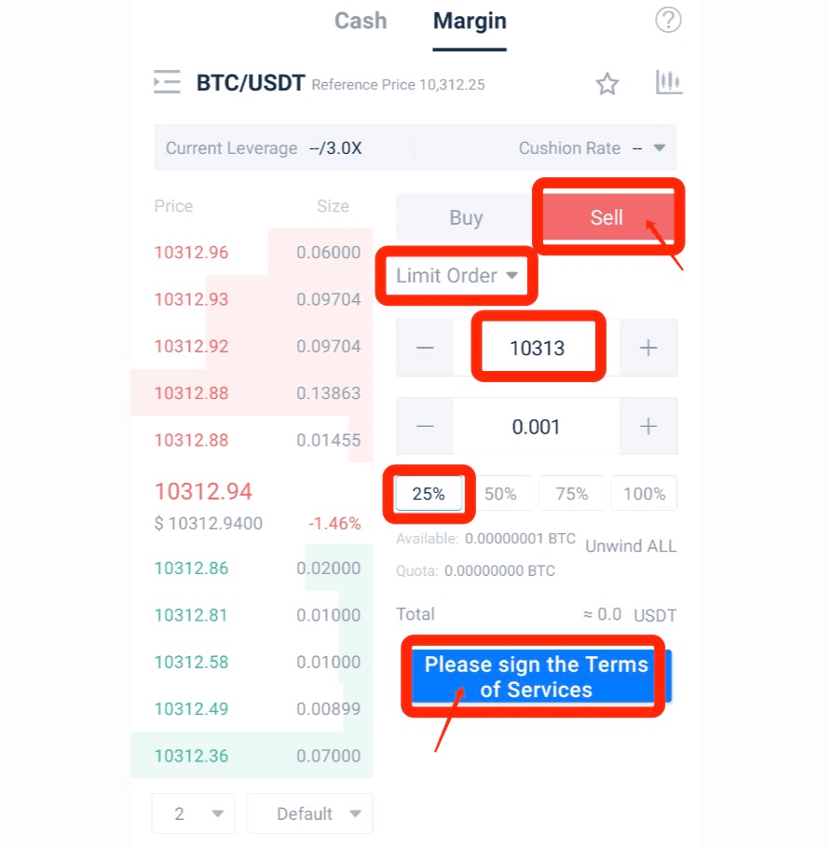

9. Take limit sell order as an example.

A. Click on [Sell] and [Limit Order].

B. Enter an order price.

C. Click on [Unwind All] and [Sell BTC]. When the order the filled, your position will be closed.

B. Enter an order price.

C. Click on [Unwind All] and [Sell BTC]. When the order the filled, your position will be closed.

To close out a market buy order, click on [Unwind All] and [Sell BTC].

AscendEX Margin Trading allows users to borrow and repay margin loan directly through trading, thus removing the manual request process.

10. Assume now you want to place a limit sell order to trade BTC/USDT.

11. If you expect BTC price to go down, you can borrow BTC from the platform to short/sell BTC.

A. Click on [Sell] and [Limit Order], enter an order price.

B. Enter an order size. Or you can select a size by clicking on one of the four options below (25%, 50%, 75% or 100%, representing a percentage of your max buy), and the system will automatically calculate the total trading volume (Total).

C. Click on [Sell BTC] to place the order.

Steps to place a market sell order are pretty similar except that you don’t need to enter an order price, since market orders are filled at the current market price.

12. To close out the limit/market sell order, you can simply place a limit/market buy order.

13. Take limit buy order as an example.

A. Click on [Buy] and [Limit Order].

B. Enter an order price.

C. Click on [Unwind All] and [Buy BTC]. When the order the filled, your position will be closed.

B. Enter an order price.

C. Click on [Unwind All] and [Buy BTC]. When the order the filled, your position will be closed.

To close out a market buy order, click on [Unwind All] and [Buy BTC].

AscendEX Margin Trading allows users to borrow and repay margin loan directly through trading, thus removing the manual request process.

(Open order of margin trading will lead to the increase of Borrowed Asset even before the order execution. However, it will not affect the Net Asset.)

Interests of margin loan are calculated and updated on user’s account page every 8 hours at 0:00 UTC/8:00 UTC/16:00 UTC/24:00 UTC. There’s no margin interest if user borrows funds and repays the loans within the 8-hour settlement cycle.

Interest portion will be repaid prior the principal portion of the loan.

Notes:

When the order is filled and you are worried that the market might move against your trade, you can always set a stop loss order to mitigate the risk of forced liquidation and potential losses. For further details, please refer to How to Stop Loss in Margin Trading [App].

How to Stop Loss in Margin Trading【PC】

1. A stop-loss order is a buy/sell order placed to mitigate the risk of forced liquidation or potential losses when you are worried that the market might move against your trade.There are two types of stop loss order on AscendEX: stop limit or stop market.

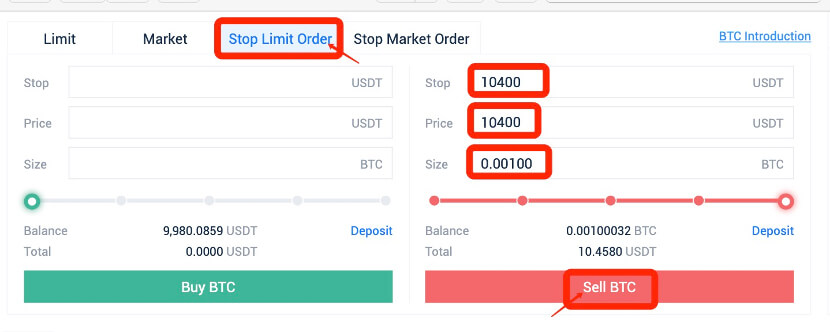

2. For example, your limit buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop limit order to sell BTC.

A. Click on [Stop Limit Order].

B. Enter a stop price and an order price. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Enter a stop price and an order price. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

3. Assume your limit sell order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop limit order to buy BTC.

4. Click on [Stop Limit Order]:

A. Enter a stop price and an order price.

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

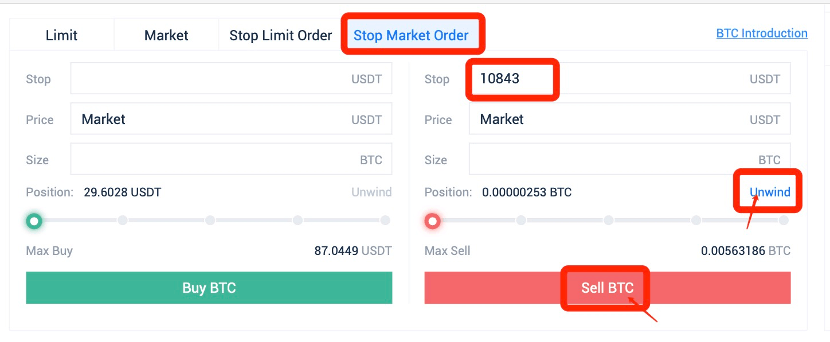

5. Assume your market buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to sell BTC.

6. Click on [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be lower than the previous buy price and current price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Stop price should be lower than the previous buy price and current price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

7. Assume your market sell order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to buy BTC.

8. Click on [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be higher than the previous sell price and current price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Stop price should be higher than the previous sell price and current price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

Notes:

You have already set a stop loss order to mitigate potential losses. However, you want to buy/sell the token before the pre-set stop price is reached, you can always cancel the stop loss order and buy/sell directly.

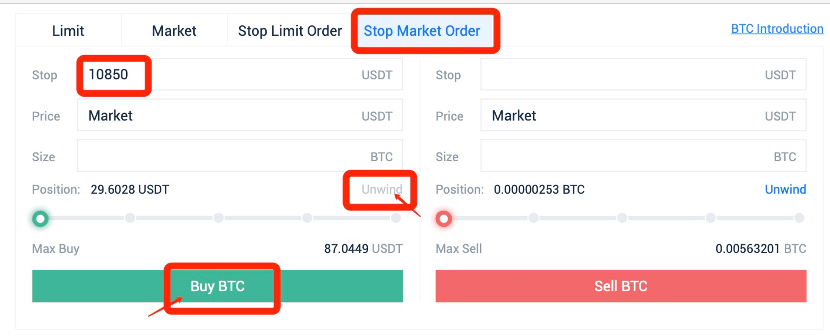

How to Stop Loss in Margin Trading 【APP】

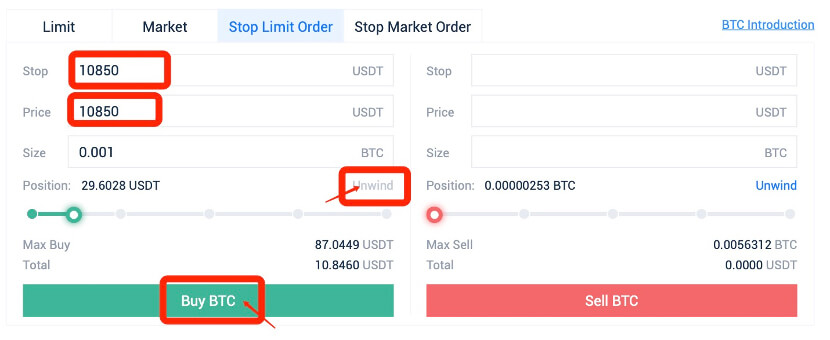

1. A stop-loss order is a buy/sell order placed to mitigate the risk of liquidation or potential losses when you are worried that the prices may move against your trade.2. For example, your limit buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop limit order to sell BTC.

A. Click on [Sell] and [Stop Limit Order]

B. Enter a stop price and an order price.

C. Stop price should be lower than the previous buy price and current price; order price should be ≤ stop price.

D. Click on [Unwind All] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

3. Assume your limit sell order of BTC has been filled. To mitigate risk of forced liquidation or potential losses, you can set a stop limit order to buy BTC.

4. Click on [Buy] and [Stop Limit Order]:

A. Enter a stop price and an order price.

B. Stop price should be higher than the previous sell price and current price; order price should be ≥ stop price.

C. Click on [Unwind All] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

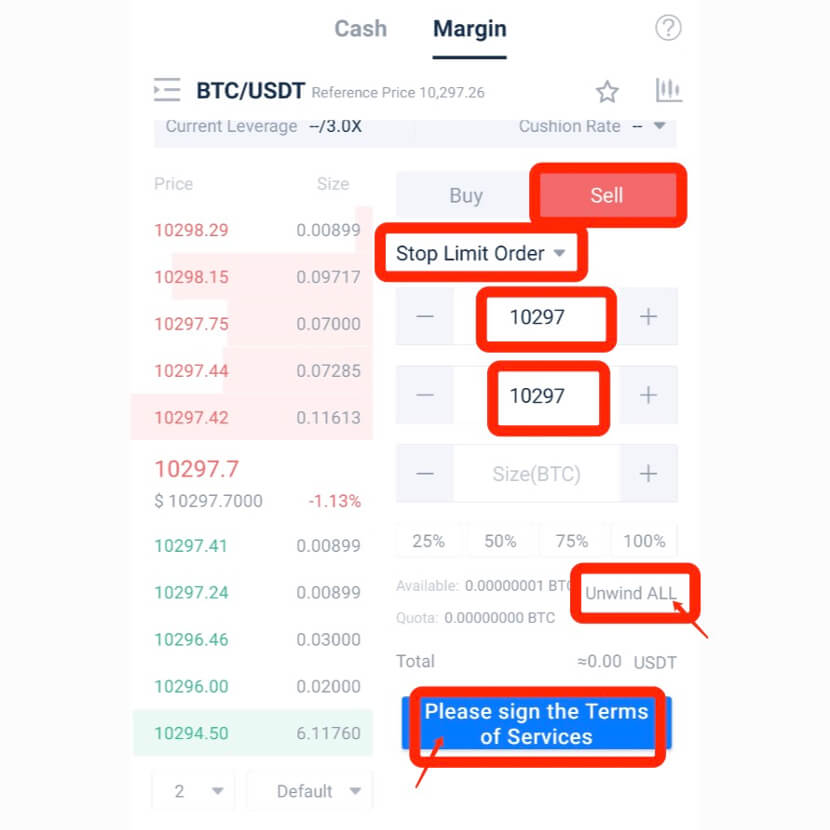

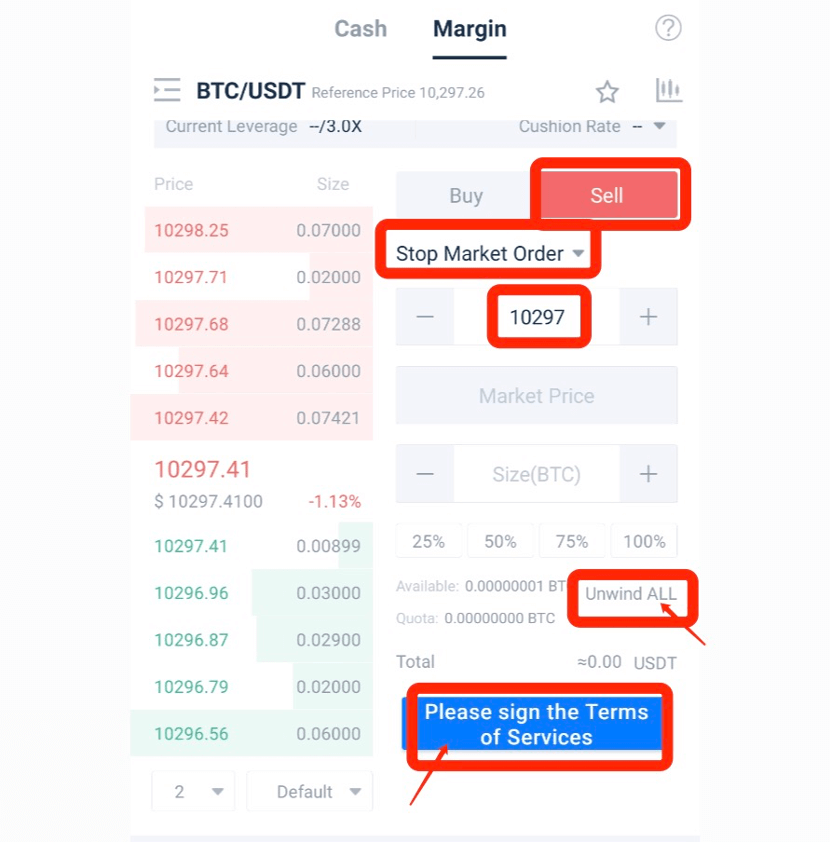

5. Assume your market buy order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to sell BTC.

6. Click on [Sell] and [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be lower than the previous buy price and current price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Stop price should be lower than the previous buy price and current price.

C. Click on [Unwind] and [Sell BTC]. When the stop price is reached, the system will automatically place and fill the order.

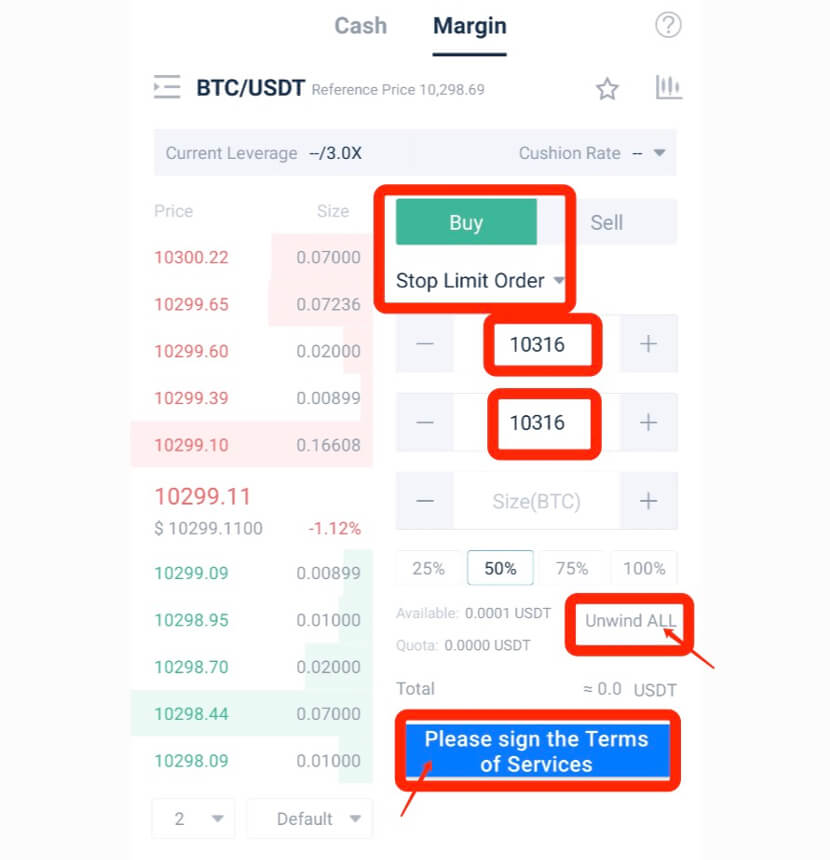

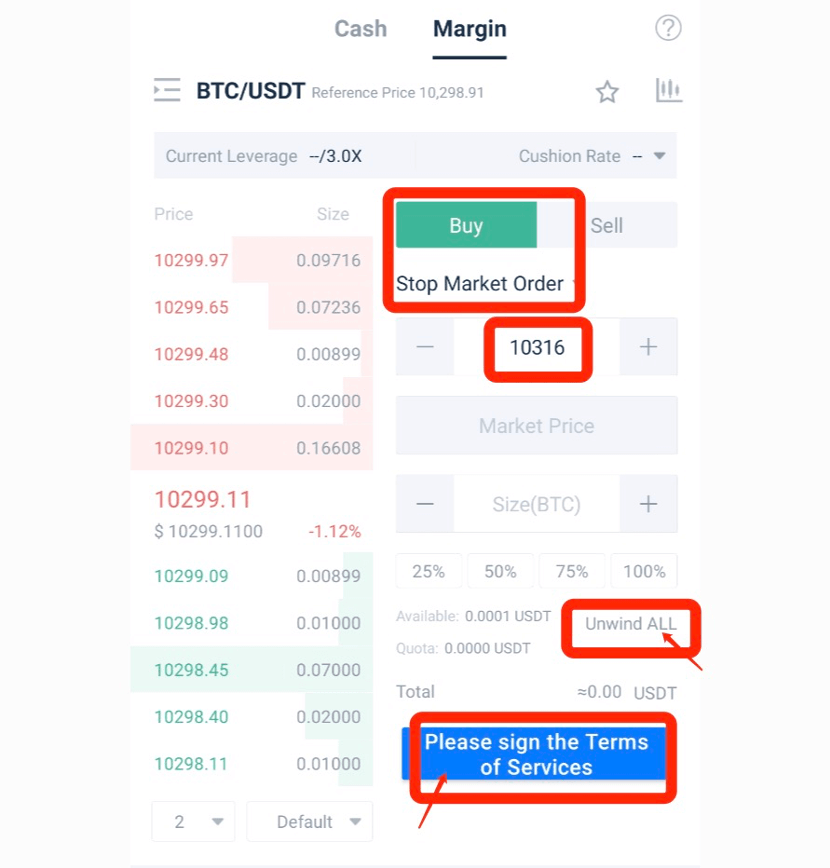

7. Assume your market sell order of BTC has been filled. To mitigate the risk of forced liquidation or potential losses, you can set a stop market order to buy BTC.

8. Click on [Buy] and [Stop Market Order]:

A. Enter a stop price.

B. Stop price should be higher than the previous sell price and current price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

B. Stop price should be higher than the previous sell price and current price.

C. Click on [Unwind] and [Buy BTC]. When the stop price is reached, the system will automatically place and fill the order.

Notes:

You have already set a stop loss order to mitigate potential losses. However, you want to buy/sell the token before the pre-set stop price is reached, you can always cancel the stop loss order and buy/sell directly.

FAQ

ASD Margin Trading Rules

- ASD margin loan interest is calculated and updated on user’s account every hour, different from other margin loans’ settlement cycle.

- For the ASD available in the Margin Account, users can subscribe to ASD Investment Product on the user’s My Asset - ASD page. Daily return distribution will be posted to the user’s Margin Account.

- ASD Investment quota in Cash Account can be transferred to Margin Account directly. ASD Investment quota in the Margin Account can be used as collateral.

- 2.5% haircut will be applied for ASD Investment quota when used as collateral for margin trading. When ASD investment quota causes the Net Asset of Margin Account lower than Effective Minimum Margin, the system will reject the product subscription request.

- Forced liquidation priority: ASD Available prior to ASD Investment quota. When a margin call is triggered, forced liquidation of ASD investment quota will be executed and 2.5% commission fee will be applied.

- Reference Price of ASD forced liquidation= Average of ASD mid-price over the last 15 minutes. Mid-price = (Best Bid + Best Ask)/2

- Users are not allowed to short ASD if there is any ASD Investment quota in either Cash Account or Margin Account.

- Once there is ASD available from investment redemption in user’s account, the user can short ASD.

- Daily return distribution of ASD Investment Product will be posted to Margin Account. It will serve as repayment for any USDT loan at that time.

- ASD interests paid by borrowing ASD will be deemed as consumption.

AscendEX Point Card Rules

AscendEX launched the Point Card in support of a 50% discount for the repayment of users’ margin interest.How to Purchase Point Cards

1. Users can purchase Point Cards on the margin trading page (Left Corner) or go to My Asset-Buy Point Card for purchase.

2. The Point Card is sold at the value of 5 USDT equivalent of ASD each. Card price is updated every 5 minutes based on the previous 1-hour average ASD price. Purchase is completed after clicking the “Buy Now” button.

3. Once ASD tokens are consumed, they will be transferred to a specific address for permanent lock-up.

How to Use Point Cards

1. Each Point Card is worth 5 points with 1 point redeemable for 1 UDST. Point’s decimal accuracy is consistent with USDT trading pair’s price.

2. Interest will always be paid with Point Cards first if available.

3. Interest incurred post purchase gets a 50% discount when paid with Point Cards. However, such discount is not applicable to existing interest.

4. Once sold, point Cards are non-refundable.

What is the Reference Price

In order to mitigate price deviation due to market volatility, AscendEX uses composite reference price for the calculation of margin requirement and forced liquidation. The reference price is computed by taking an average last trade price from the following five exchanges - AscendEX, Binance, Huobi, OKEx and Poloniex, and removing the highest and the lowest price.AscendEX reserves the right of updating pricing sources without notice.